|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Understanding the Credit Score List: A Comprehensive Guide

What is a Credit Score?

A credit score is a numerical representation of your creditworthiness, used by lenders to determine the risk of lending money to you. It ranges from 300 to 850, with higher scores indicating better creditworthiness.

Importance of a Good Credit Score

Having a good credit score can help you secure loans at favorable interest rates, qualify for higher credit limits, and even impact your rental applications and insurance premiums.

Components of a Credit Score

- Payment History: Accounts for about 35% of your score. Timely payments improve this significantly.

- Credit Utilization: Makes up 30% of your score, reflecting the ratio of your credit card balances to credit limits.

- Length of Credit History: Contributes 15%, favoring longer credit histories.

- New Credit: Comprises 10% and considers recent credit inquiries.

- Credit Mix: The remaining 10% looks at the variety of credit types you use.

How to Check Your Credit Score

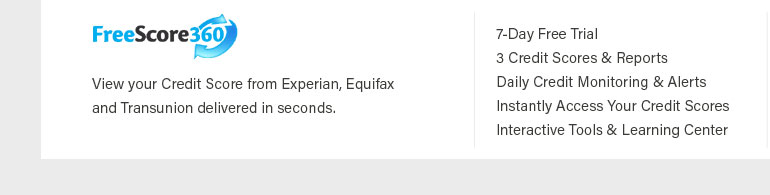

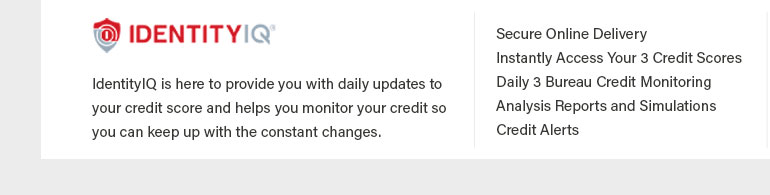

It’s important to regularly monitor your credit score. You can access your report through services like experian view credit report for detailed insights into your credit health.

Improving Your Credit Score

- Pay Bills on Time: Consistency in payments is crucial.

- Reduce Debt: Lowering your credit card balances can boost your score.

- Avoid New Hard Inquiries: Each inquiry can reduce your score by a few points.

- Check Your Credit Report: Regularly reviewing your report for errors can help maintain accuracy.

FAQ

What is a good credit score range?

A good credit score typically ranges from 670 to 739. Scores above 740 are considered very good to excellent.

How often should I check my credit score?

It’s advisable to check your credit score at least once a year through resources like three on one credit reports to stay informed and spot potential inaccuracies.

Can I improve my credit score quickly?

Improving your credit score is usually a gradual process. Paying off debts, reducing your credit utilization, and maintaining timely payments are effective strategies.

However, a score doesn't consistently correlate with a specific likelihood of missing a payment. Instead, credit scores are a ranking system ...

The primary factors that affect your credit score include payment history, the amount of debt you owe, how long you've been using credit, new or recent credit, ...

Most credit scores range from about 300 to about 850, and the higher, the better. At the end of the day, your personal credit score is what moves the needle.

![]()